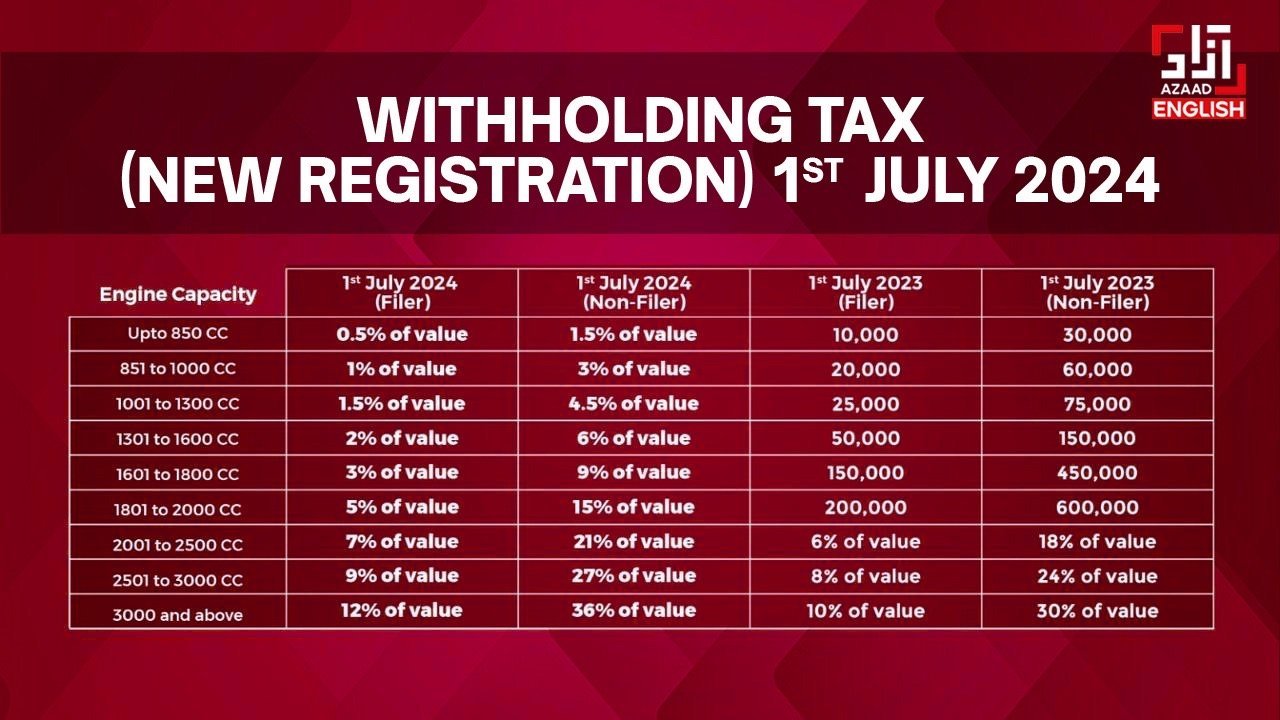

In June 2024, the government introduced a new tax policy for local cars in Pakistan. This policy changes how Withholding Tax (WHT) is calculated on brand-new cars. Instead of being based on engine size as before, WHT will now be calculated based on the car’s invoice price, which reflects its value.

Under the revised policy, the WHT percentage varies depending on whether the taxpayer is a filer or a non-filer. Filer taxpayers will pay 1% of the car’s value, while non-filers will pay a higher rate of 3%.

This new policy took effect from 1st July 2024 and also includes an increased WHT percentage for cars with engine sizes above 2,000cc.

Read More: Changan Pakistan to launch 7-seater Oshan X7

Critics of the policy argue that it will worsen the already challenging situation in the Pakistani automotive market, where cars are already considered expensive.

However, proponents of the policy argue that taxing based on a car’s value rather than engine size makes more sense and ensures a fairer tax structure.

This change will impact cars across different price ranges, affecting models like Alto, WagonR, and Cultus, among others.